Triangle Pattern Forex

Either way, pattern trading, coupled with a good money management system, is profitable. Last touch to the border opposite to the breakout border:

Forex Price Action Symmetrical Triangle MT4 Chart

Forex Price Action Symmetrical Triangle MT4 Chart

Technical analysis means looking at price action and structures, or charts, and then taking an educated guess regarding the future movement the price is going to make.

Triangle pattern forex. Triangle pattern forex trading strategy There are basically 3 types of triangles and they all point to price being in consolidation: The triangle is a continuation pattern.

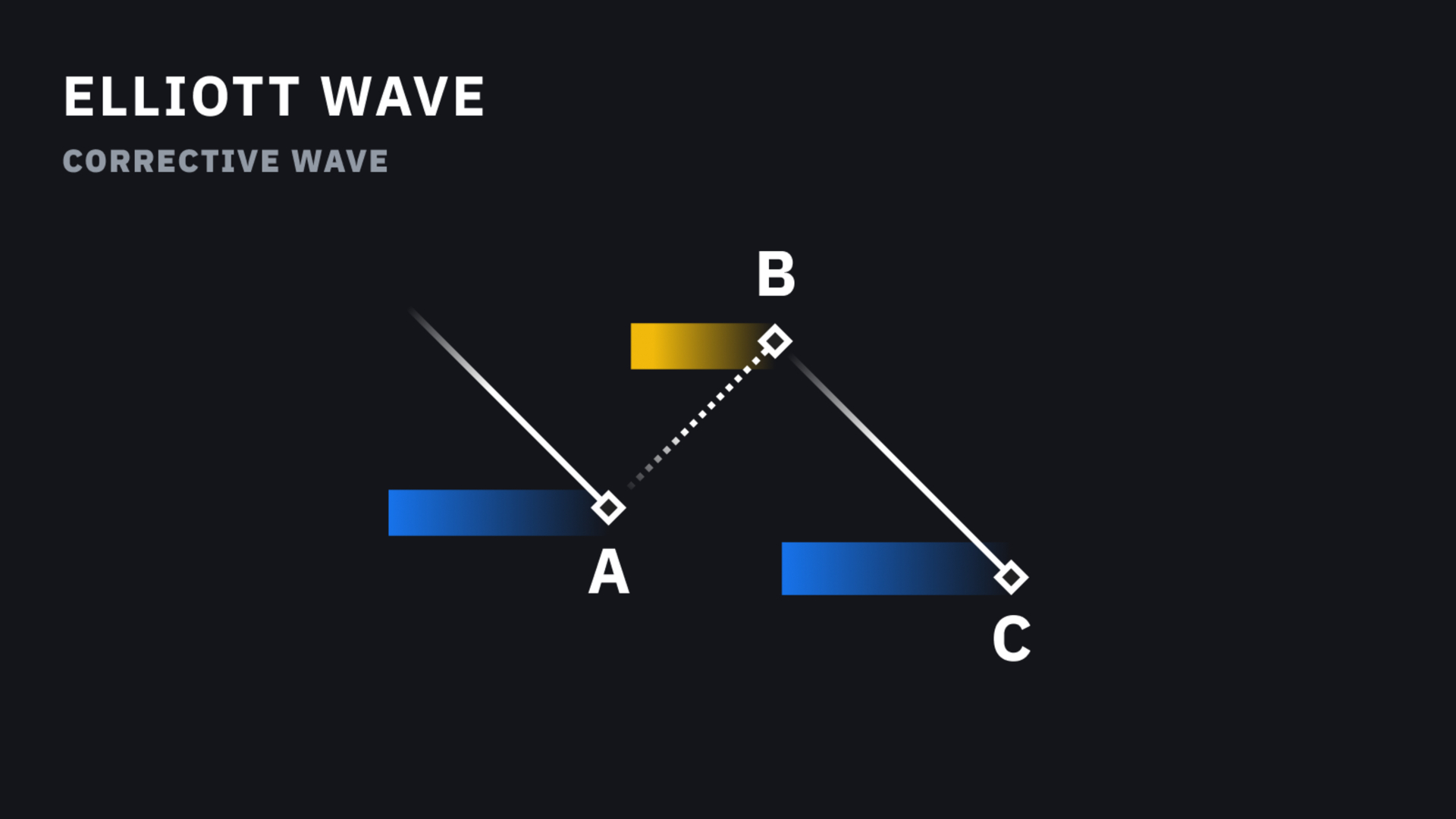

Expanding triangle pattern in forex. The “triangle” pattern is a simple technical analysis tool which is a series of falling tops and rising bottoms (4 points are required to draw the pattern). In most of the situations, this is a continuation chart pattern that is why you need to pay specific attention to the price action.

In this formation, it seems that prices move to form lower high levels (lower highs) and higher low levels (higher lows). It is a pattern that shows how traders’ excitement and trading activity starts strong then gradually dissipates and dies out before the market decides as to where price should be. Trade forex effectively with a triangle pattern for binary options.

Description of the triangle pattern. Pattern target (take profit) failure (stop loss 1) failure (stop loss 2) symmertrical triangle ascending triangle descending triangle: So that the pattern resembles an equilateral or symmetrical triangle.

Trading implies forecasting future price movements the market is going to make but it should be. The triangle pattern is a specific figure formed on the price chart, typically identified when the tops and the bottoms of the price action are moving toward each other like the sides of a triangle. How to open an order is as follows:

Once the descending triangle formation is completed, we wait for a candle to breakout from the pattern, as it did at e. When the upper and the lower level of a triangle interact, traders expect an eventual breakout from the triangle. Forex triangle pattern indicator is a meta trader indicator that is uncommonly produced for the forex trading framework and it is extremely useful for the forex trading framework.

The triangle pattern appears on different charts rather frequently. There are several types of the triangle, each of them having its own specific features. These are important patterns for a number of reasons:

With this type of trading, everything needs to be absolutely accurate and secure. However, in my opinion, this pattern may equally work in line with or against the existing trend. Triangle patterns are constructed by straight lines of highs and lows.

Descending triangles are generally considered bearish. At the start of its formation, the triangle is at its widest point. Simply put, it represents two lines crossing each other and thereby forming a triangle.

The triangle pattern, in its three forms, is one of the common stock patterns for day trading that you should be aware of. In general, there are three types of triangle patterns: The retest point of the triangle pattern is a safe entry signal.

But still, if you could gain 20%, 30%, even a 100% on your trading account, that’s not bad at all. The classic technical analysis considers it a pattern signifying the continuation of the trend; When forex traders talk about the triangle pattern, they are indicating a very specific chart pattern, usually identified when the upper and lower ends of a price action form trend lines or a combination of a trend line and a horizontal line that intersect each other, creating a triangle.

Ascending triangle, descending triangle and symmetrical triangle. Pattern day or swing trading is a very effective tool forex traders could include in their arsenal of trading setups. The triangle pattern is generally categorized as a “continuation pattern”, meaning that after the pattern completes, it’s assumed that price will continue in the trend direction it was moving before the pattern appeared.

Distance of the first swing, applied from breakout rate: The symmetrical triangle pattern forex is a formation where the slope of the high levels and the slope line of the low levels meet at a point. Symmetrical (price is contained by 2 converging trend lines with a similar slope), ascending (price is contained by a horizontal trend line acting as resistance and an.

As you know from the forex guidebook, there are three types of triangle chart patterns: The videos are showing what a triangle is, how many legs it has, and what to be expected. This is being called a forecast.

Generally, a triangle pattern is considered to be a continuation or consolidation pattern.sometimes, however, the formation marks a reversal of a trend. Introduction to the triangle chart pattern. A triangle chart pattern involves price moving into a tighter and tighter range as time goes by and provides a visual display of a battle between bulls and bears.

Triangles can be best described as horizontal trading patterns. As the market continues to trade in a sideways pattern, the. Be mindful of the trend direction previous to the triangle formation.

The best thing about pattern trading is that it applies to all timeframes, from m1, m5, m15, h1, h4, up to the day by day timeframe, and to every types of trading, either it be scalping, day trading, or swing trading. The triangle pattern in forex is a price formation that signals a potential trend continuation after a brief consolidation. Pattern day or swing trading is a identical use of tool forex traders can incorporate in their store of trading setups.

They show a decrease in volatility that could eventually expand again. There are three different triangle patterns that are each discussed below; The triangle chart pattern is formed by drawing two converging.

Well, he might have been lucky. This indicator is utilized to identify the triangles pattern in the forex market that shows up because of the value activity changes of the forex currency pairs. One of the most popular, and commonly seen pattern is the triangle pattern.

The symmetrical triangle pattern is a classic sideways pattern where the market is consolidating. Head and shoulders inverse head and shoulders The triangle candlestick pattern can be used on your trading platform charts to help filter potential trading signals as part of an overall forex trading strategy.

Triangles Chart Pattern Forex Winners Free Download

ASAS FOREX Chart Patterns (Corak Carta) ForexKini

ASAS FOREX Chart Patterns (Corak Carta) ForexKini

3 Easy Triangle Patterns Every Forex Trader Should Know

3 Easy Triangle Patterns Every Forex Trader Should Know

ForexUseful There are many Forex Chart patterns but its

ForexUseful There are many Forex Chart patterns but its

3 Easy Triangle Patterns Every Forex Trader Should Know

3 Easy Triangle Patterns Every Forex Trader Should Know

Forex Chart Pattern Tricks Forex Technical Analysis

Forex Chart Pattern Tricks Forex Technical Analysis

Пин на доске Forex Infographics

Пин на доске Forex Infographics

Your detailed guide to the Elliott Wave expanding triangle

Your detailed guide to the Elliott Wave expanding triangle

Forex Chart Patterns Forex Chart Patterns New Emerging

Forex Chart Patterns Forex Chart Patterns New Emerging

Ascending Triangle Pattern 📌 in 2020

Ascending Triangle Pattern 📌 in 2020

Master Trading Triangle Patterns to Increase Your Win Rate

Master Trading Triangle Patterns to Increase Your Win Rate

Expanding Triangle Forex Trading Technical Analysis

Expanding Triangle Forex Trading Technical Analysis

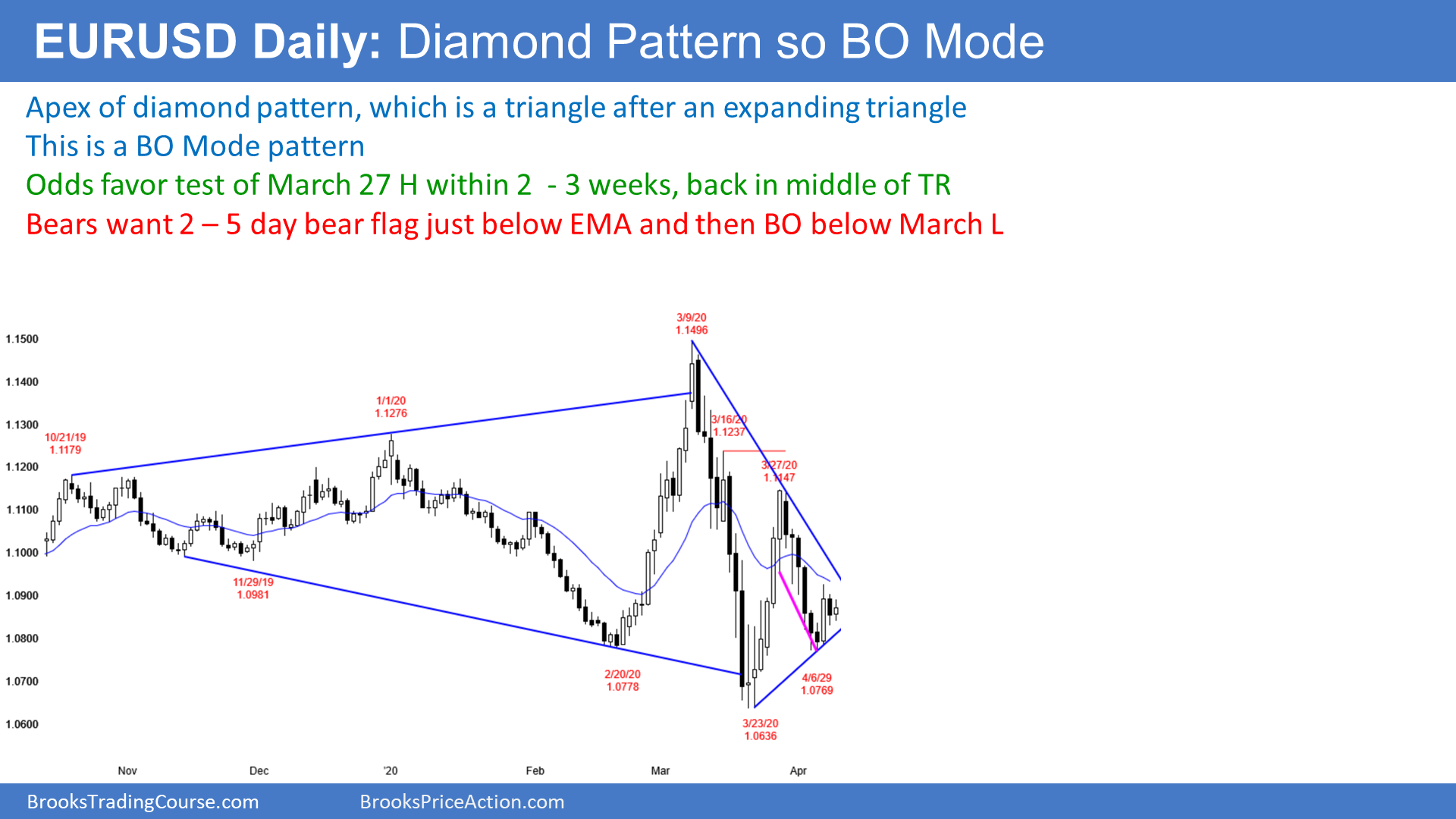

Emini should test 50 percent pullback from bear trend

Emini should test 50 percent pullback from bear trend

TradeGenius spots a descending triangle pattern on the

TradeGenius spots a descending triangle pattern on the

3 Easy Triangle Patterns Every Forex Trader Should Know

3 Easy Triangle Patterns Every Forex Trader Should Know

Forex symmetrical triangle and breakout

Forex symmetrical triangle and breakout

3 Easy Triangle Patterns Every Forex Trader Should Know

3 Easy Triangle Patterns Every Forex Trader Should Know

Triangles Chart Pattern Forex Winners Free Download

Comments

Post a Comment